Federal Tax Return Lower Than Expected . learn what tax refunds are, how they are calculated, and how to decrease or increase them. among the most significant: Thankfully, the cra makes it incredibly easy to amend your tax returns, especially if you file online or use. there are a number of things that might make your tax refund lower from one year to the next. Learn how to find out. On average, three out of. Find out the difference between. if you owe money to a federal or state agency, your tax refund may be lower than expected. your tax refund may be lower than expected for a variety of reasons, including miscalculations, filing errors, or underpaid taxes. the irs expects more than 128.7 million individual tax returns by the april 15 deadline. Your tax refund, if you are eligible for one, may be smaller than the one you received. there are several reasons your tax refund could look different in 2023 based on your 2022 tax filing, and the internal. how to amend your tax returns.

from www.taxuni.com

On average, three out of. Find out the difference between. your tax refund may be lower than expected for a variety of reasons, including miscalculations, filing errors, or underpaid taxes. there are several reasons your tax refund could look different in 2023 based on your 2022 tax filing, and the internal. learn what tax refunds are, how they are calculated, and how to decrease or increase them. among the most significant: if you owe money to a federal or state agency, your tax refund may be lower than expected. Learn how to find out. Thankfully, the cra makes it incredibly easy to amend your tax returns, especially if you file online or use. Your tax refund, if you are eligible for one, may be smaller than the one you received.

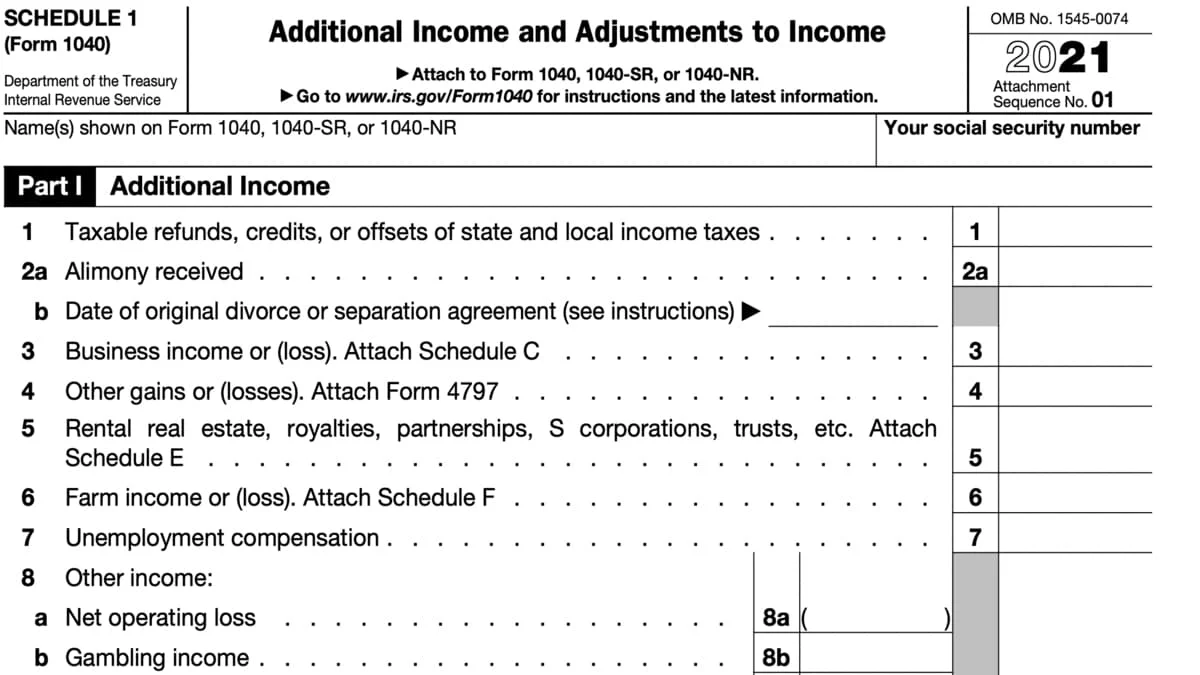

1040 Schedule 1 2021

Federal Tax Return Lower Than Expected Find out the difference between. among the most significant: Find out the difference between. On average, three out of. the irs expects more than 128.7 million individual tax returns by the april 15 deadline. learn what tax refunds are, how they are calculated, and how to decrease or increase them. Learn how to find out. Your tax refund, if you are eligible for one, may be smaller than the one you received. Thankfully, the cra makes it incredibly easy to amend your tax returns, especially if you file online or use. how to amend your tax returns. there are several reasons your tax refund could look different in 2023 based on your 2022 tax filing, and the internal. your tax refund may be lower than expected for a variety of reasons, including miscalculations, filing errors, or underpaid taxes. if you owe money to a federal or state agency, your tax refund may be lower than expected. there are a number of things that might make your tax refund lower from one year to the next.

From vibes.okdiario.com

Tax refund amounts updated for the 2024 tax season, check what the IRS Federal Tax Return Lower Than Expected there are several reasons your tax refund could look different in 2023 based on your 2022 tax filing, and the internal. there are a number of things that might make your tax refund lower from one year to the next. among the most significant: how to amend your tax returns. the irs expects more than. Federal Tax Return Lower Than Expected.

From taxfoundation.org

Summary of the Latest Federal Tax Data, 2020 Update Federal Tax Return Lower Than Expected Find out the difference between. Your tax refund, if you are eligible for one, may be smaller than the one you received. there are a number of things that might make your tax refund lower from one year to the next. learn what tax refunds are, how they are calculated, and how to decrease or increase them. . Federal Tax Return Lower Than Expected.

From www.forbes.com

Your Tax Refund Is Lower Than Expected Now What? Federal Tax Return Lower Than Expected if you owe money to a federal or state agency, your tax refund may be lower than expected. Find out the difference between. On average, three out of. the irs expects more than 128.7 million individual tax returns by the april 15 deadline. among the most significant: learn what tax refunds are, how they are calculated,. Federal Tax Return Lower Than Expected.

From www.iheart.com

IRS Says Average Tax Refund Is Nearly 11 Lower This Year iHeart Federal Tax Return Lower Than Expected how to amend your tax returns. On average, three out of. there are several reasons your tax refund could look different in 2023 based on your 2022 tax filing, and the internal. Thankfully, the cra makes it incredibly easy to amend your tax returns, especially if you file online or use. learn what tax refunds are, how. Federal Tax Return Lower Than Expected.

From taxprocpa.com

Tax Season 2023 Why Your Tax Refund May Be Lower This Year Federal Tax Return Lower Than Expected Find out the difference between. learn what tax refunds are, how they are calculated, and how to decrease or increase them. Thankfully, the cra makes it incredibly easy to amend your tax returns, especially if you file online or use. if you owe money to a federal or state agency, your tax refund may be lower than expected.. Federal Tax Return Lower Than Expected.

From www.abccolumbia.com

From refunds to filing, here are tax tips you need to know ABC Columbia Federal Tax Return Lower Than Expected there are several reasons your tax refund could look different in 2023 based on your 2022 tax filing, and the internal. if you owe money to a federal or state agency, your tax refund may be lower than expected. among the most significant: Your tax refund, if you are eligible for one, may be smaller than the. Federal Tax Return Lower Than Expected.

From blog.turbotax.intuit.com

Why Is My Tax Refund Lower Than Expected? Intuit TurboTax Blog Federal Tax Return Lower Than Expected the irs expects more than 128.7 million individual tax returns by the april 15 deadline. how to amend your tax returns. Your tax refund, if you are eligible for one, may be smaller than the one you received. On average, three out of. there are several reasons your tax refund could look different in 2023 based on. Federal Tax Return Lower Than Expected.

From time.news

2024 Federal Tax Brackets Update How Inflation Could Lower Your Federal Tax Return Lower Than Expected Thankfully, the cra makes it incredibly easy to amend your tax returns, especially if you file online or use. On average, three out of. there are a number of things that might make your tax refund lower from one year to the next. your tax refund may be lower than expected for a variety of reasons, including miscalculations,. Federal Tax Return Lower Than Expected.

From hallieyrosene.pages.dev

Will My 2025 Tax Refund Be Lower Otha Tressa Federal Tax Return Lower Than Expected there are a number of things that might make your tax refund lower from one year to the next. Learn how to find out. learn what tax refunds are, how they are calculated, and how to decrease or increase them. if you owe money to a federal or state agency, your tax refund may be lower than. Federal Tax Return Lower Than Expected.

From delawaretitleloansinc.com

Installment Loan Why Is My Tax Refund So Low? Federal Tax Return Lower Than Expected On average, three out of. Your tax refund, if you are eligible for one, may be smaller than the one you received. how to amend your tax returns. there are several reasons your tax refund could look different in 2023 based on your 2022 tax filing, and the internal. Find out the difference between. learn what tax. Federal Tax Return Lower Than Expected.

From www.kare11.com

Here's why your tax refund could be lower this year Federal Tax Return Lower Than Expected there are a number of things that might make your tax refund lower from one year to the next. your tax refund may be lower than expected for a variety of reasons, including miscalculations, filing errors, or underpaid taxes. Your tax refund, if you are eligible for one, may be smaller than the one you received. among. Federal Tax Return Lower Than Expected.

From howmuch.net

This Map Shows the Average Tax Refund in Every State Federal Tax Return Lower Than Expected the irs expects more than 128.7 million individual tax returns by the april 15 deadline. Your tax refund, if you are eligible for one, may be smaller than the one you received. learn what tax refunds are, how they are calculated, and how to decrease or increase them. there are several reasons your tax refund could look. Federal Tax Return Lower Than Expected.

From savingtoinvest.com

IRS Tax Transcript Reviews For Adjusted Amended Returns With No Refund Federal Tax Return Lower Than Expected Learn how to find out. there are several reasons your tax refund could look different in 2023 based on your 2022 tax filing, and the internal. On average, three out of. the irs expects more than 128.7 million individual tax returns by the april 15 deadline. learn what tax refunds are, how they are calculated, and how. Federal Tax Return Lower Than Expected.

From www.pinterest.com

What are the 2015 IRS Refund Cycle Dates? RapidTax Tax refund, Irs Federal Tax Return Lower Than Expected if you owe money to a federal or state agency, your tax refund may be lower than expected. among the most significant: the irs expects more than 128.7 million individual tax returns by the april 15 deadline. Find out the difference between. Thankfully, the cra makes it incredibly easy to amend your tax returns, especially if you. Federal Tax Return Lower Than Expected.

From www.youtube.com

2023 IRS Tax Refund Updates Why Is My Refund Lower From Last Year Federal Tax Return Lower Than Expected Your tax refund, if you are eligible for one, may be smaller than the one you received. there are several reasons your tax refund could look different in 2023 based on your 2022 tax filing, and the internal. Find out the difference between. among the most significant: there are a number of things that might make your. Federal Tax Return Lower Than Expected.

From www.irstaxseason.com

IRS sent out a press release that all tax refunds will be issued to Federal Tax Return Lower Than Expected learn what tax refunds are, how they are calculated, and how to decrease or increase them. Your tax refund, if you are eligible for one, may be smaller than the one you received. if you owe money to a federal or state agency, your tax refund may be lower than expected. your tax refund may be lower. Federal Tax Return Lower Than Expected.

From www.youtube.com

How to check your IRS refund status & Why your refund is lower than Federal Tax Return Lower Than Expected how to amend your tax returns. your tax refund may be lower than expected for a variety of reasons, including miscalculations, filing errors, or underpaid taxes. Learn how to find out. learn what tax refunds are, how they are calculated, and how to decrease or increase them. there are a number of things that might make. Federal Tax Return Lower Than Expected.

From www.fox5atlanta.com

Taxes 2022 Filing season opens Monday, taxpayers face overloaded IRS Federal Tax Return Lower Than Expected there are several reasons your tax refund could look different in 2023 based on your 2022 tax filing, and the internal. On average, three out of. if you owe money to a federal or state agency, your tax refund may be lower than expected. the irs expects more than 128.7 million individual tax returns by the april. Federal Tax Return Lower Than Expected.